Ryan Kuster cuts first crop hay of 2016 for his family’s beef cattle.

Capital is the lifeblood of any farming and ranching operation, and in the recently completed fiscal year the U.S. Department of Agriculture’s (USDA) Farm Loan Programs pumped $5.9 billion in support to a diverse group of producers across America, which was the second highest total in Farm Service Agency (FSA) history. Over $2.5 billion of that total was direct and guaranteed operating loans, and another $3.5 billion was allocated for direct and guaranteed farm ownership loans. The $5.9 billion in new lending continued the recent growth in FSA’s farm loan portfolio. By the end of the fiscal year, FSA was providing credit, either directly or guaranteed through commercial lenders, to 120,000 family farmers across the country.

Though their family no longer dairy farms, the effects of the dairy operation are felt today even as Ryan’s family has switched to a beef and crop operation. This calf was born a full year after all the Holstein cattle were sold.

As impressive as these statistics are, the true value of the programs is in the stories of the lives these loans change for the better, and the opportunities they provide. For example:

- Chelten and Stephen Hasty are beginning farmers with a cow/calf operation in Gasconade and Warren counties in Missouri. The Hastys used the FSA Farm Ownership and Operating Loan Programs to help build their cattle business. They sell a variety of meat products, including beef sticks and jerky, and beef cuts processed from cattle they raise.

- After a brewing hobby turned into wine crafting, Hillary and Diane Dean dreamed about expanding their modest hobby into a business venture. With the help of FSA’s Microloan Program, Hillary and Diane opened Blue River Valley Winery in Oklahoma in 2015. They sold more than 15,000 bottles of their handcrafted wine in 2016 and currently grow muscadine grapes, along with other grape varieties. They also purchase juice from several vineyards across the country to keep up with demand.

- Ryan and Travis Kuster grew up on their family’s operation, Kuster Farms, in Wisconsin. While still working with their father, Ryan and Travis are starting an operation of their own. “FSA’s operating loans can keep a farming operation running during the low and high times that there are with farming,” said Ryan. “It has helped me take out a large amount to operate, which I never could have done alone.”

- Koua Thao, formerly of Laos, aims to grow his already successful farming operation in Miller County, Arkansas, with some help from USDA. In January 2005, Thao used a USDA FSA Guaranteed Farm Ownership loan of $30,000 to purchase a hen breeding farm with two henhouses on 40 acres. Last year, Thao wished to diversify his farming operation, so he obtained a microloan to purchase 22 cows and one bull.

- Lauri Roberts, owner of Farming Turtles in Rhode Island, acquired a Farm Ownership Loan and two Farm Operating Loans, allowing her to obtain property and greenhouses needed to grow and expand her microgreen business. Products from her operation are sold in multiple supermarkets in Rhode Island, New York City and the New England area. Her microgreens are also featured on numerous restaurant menus in Rhode Island and Massachusetts.

Lauri Roberts acquired an FSA Farm Ownership Loan and two Farm Operating Loans, allowing her to obtain the property and the greenhouses needed in order to grow and expand her business into what it is today.

These are just five of the literally thousands of loan success stories from across the country. Since FSA provides credit when applicants cannot qualify for commercial loans, it’s clear that the achievements of these operations, and many others, would not have been possible without the help of FSA.

No matter what your current situation is, I encourage you to check out our loan programs. In the 2017 fiscal year, over 25,300 of the loans we made were to farmers classified as “beginning” or “socially disadvantaged”. Almost 1,400 loans went to veterans and of the 6,900 microloans we made, over 1,100 went to female applicants.

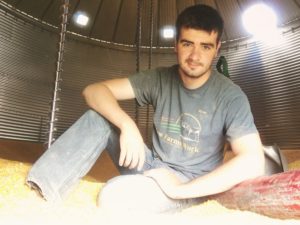

Ryan Kuster waits for his brother Travis to start the grain bin auger so they can empty the remainder of the previous year’s corn crop.

Whether you have a driving passion to raise vegetables, grain, livestock or run a dairy, chances are we have a loan program that is right for you. FSA also recently partnered with the national organization SCORE to help interested producers draft a business plan and obtain training and mentorship that will aid in assisting the producer in becoming successful with their production agriculture venture.

The first step is to reach out to any of the over 2,100 FSA offices across the country. We’re here to help you achieve your agricultural goals.

Ryan Kuster had to jump over a fence and lasso one of his cows that got out. Luckily Rosie followed him right back in!